RELX Share Price Prediction Using AI: Trends, Risks, and Buying Signals

A simple AI-based look at RELX share price trends, future growth, and smart buying opportunities

Investors looking at the RELX stock market price often want clear answers, not hype. This article breaks down the relx share price using simple language, real trends, and AI-based thinking so anyone can understand what may come next.

RELX is a global company known for data, analytics, and digital tools. Its shares attract long-term investors who prefer steady growth over fast moves.

The Business Behind the Shares

RELX earns money by selling information services. These services help businesses, scientists, and legal firms make better decisions.

Because the company focuses on digital products, it depends less on physical goods. This gives RELX a stable base compared to many traditional firms.

How Artificial Intelligence Looks at Market Trends?

AI studies past prices, volumes, and patterns. It does not predict the future perfectly, but it highlights likely paths.

For the relx share price, AI models often look for slow but steady upward movement. This matches the company’s history of stable growth.

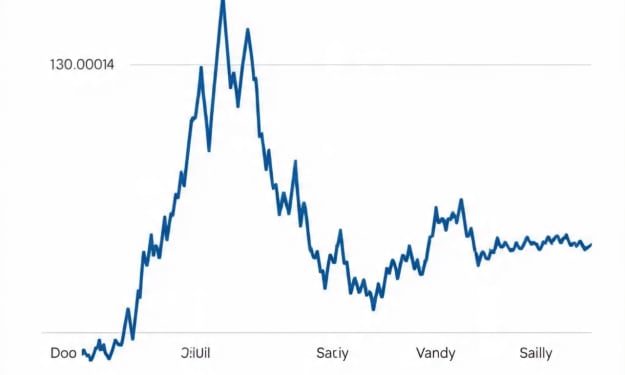

RELX Stock Market Price and Long-Term Patterns

When reviewing the RELX stock market price, long-term charts matter more than daily moves. Over the years, the price trend has shown gradual climbs with limited sharp drops.

This pattern often appeals to cautious investors. It suggests confidence from the market rather than short-term speculation.

Key Factors That Influence Daily Price Changes

Several forces shape the relx share price each day. These factors work together, not alone.

Company earnings reports

Global economic conditions

Interest rate changes

Investor confidence in tech and data firms

Even small news can cause short-term movement.

The Role of Dividends in Share Value

RELX is known for paying regular dividends. This makes the relx share price attractive to income-focused investors.

Dividends also act as a cushion. When prices dip, regular payouts help balance returns.

Risks Every Investor Should Understand

No stock is risk-free, and RELX is no exception. Even strong companies face challenges.

Some key risks include:

Slower global growth

Changes in data regulations

Increased competition in digital services

These risks may affect the relx share price over time.

AI-Based Buying Signals Explained Simply

AI buying signals are based on patterns, not emotions. When the relx share price moves near long-term support levels, AI often flags potential buying zones.

These signals work best when combined with patience. They are more helpful for long-term planning than quick trades.

Comparing RELX With Similar Companies

RELX often gets compared to other data and publishing firms. In many cases, it shows lower volatility.

This lower volatility helps keep the relx share price more predictable. Investors who dislike sharp swings often prefer this type of stock.

Why Long-Term Investors Watch This Stock?

Long-term investors focus on business strength, not daily noise. RELX fits this mindset well.

The relx share price reflects steady demand for information services. As more industries rely on data, this demand may continue.

Market Sentiment and Investor Psychology

Investor mood plays a big role in price movement. Positive earnings often lift the relx share price even if growth is modest.

Fear, on the other hand, can push prices down briefly. AI tools help smooth out these emotional swings by focusing on data.

How Economic Cycles Affect Performance?

During strong economies, companies invest more in data tools. This supports revenue growth at RELX.

In weaker times, the relx share price may slow but often avoids deep drops. This resilience is one reason investors trust the stock.

Final Thoughts

The relx share price reflects a business built on stability, data, and long-term demand. AI analysis suggests steady trends rather than sudden jumps, which suits patient investors.

If you are watching the RELX stock market price, focus on long-term signals instead of daily noise. A calm, informed approach can help you decide if this stock fits your goals.

Comments

There are no comments for this story

Be the first to respond and start the conversation.