MicroStrategy Bitcoin Trend: How This Move Is Reshaping Corporate Investment

This article explores why MicroStrategy Bitcoin is changing the rules of corporate finance and what it means for other companies.

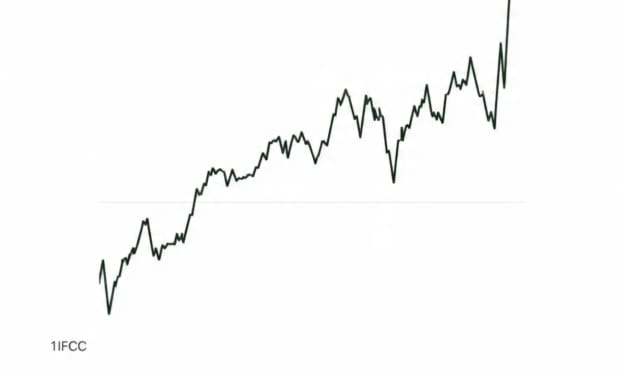

MicroStrategy Bitcoin has become a trendsetter in corporate finance. The company’s bold decision to hold significant amounts of Bitcoin has captured the attention of investors and businesses worldwide. MicroStrategy Bitcoin is not just about profit it is a strategic move that demonstrates the future of business investments. This article explores why MicroStrategy Bitcoin is changing the rules of corporate finance and what it means for other companies.

How MicroStrategy Bitcoin Began

MicroStrategy Bitcoin started as a simple idea: protect company funds with digital assets. Instead of keeping all cash, the company bought Bitcoin as a long-term store of value. This strategy marked the start of a trend that would influence the corporate world. By adopting Bitcoin early, MicroStrategy Bitcoin positioned itself as a leader in innovative finance. The company’s approach showed that embracing digital assets could bring both security and growth potential.

Core Elements of MicroStrategy Bitcoin Strategy

Steady Investment Over Time

MicroStrategy Bitcoin focuses on consistent purchases rather than a single large investment. Regularly adding Bitcoin strengthens the company’s position while reducing exposure to sudden market swings.

Leadership Driving Confidence

CEO Michael Saylor’s support for Bitcoin has been central to the strategy. His vision and public statements build trust with investors, ensuring MicroStrategy Bitcoin remains a deliberate and long-term plan rather than a short-term gamble.

Financial Impact of MicroStrategy Bitcoin

Increased Market Attention

Every new Bitcoin purchase by MicroStrategy makes headlines. Investors and analysts closely watch MicroStrategy Bitcoin for trends and insights. This attention has boosted the company’s visibility and credibility.

Strengthening Corporate Assets

Adding Bitcoin to the balance sheet has increased the company’s overall value. MicroStrategy Bitcoin diversifies the company’s assets, providing protection against traditional market risks and creating opportunities for long-term growth.

How MicroStrategy Bitcoin Influences Other Businesses

MicroStrategy Bitcoin is inspiring other companies to consider digital assets. Businesses now see that Bitcoin can be a tool for growth and risk management. For companies exploring corporate cryptocurrency, our article on corporate Bitcoin adoption strategies offers detailed insights on how businesses are successfully using digital assets to strengthen their financial position.

Risks and Challenges

Bitcoin is volatile, and MicroStrategy Bitcoin faces the same risks. Price swings can create short-term challenges, and holding large amounts of cryptocurrency requires careful planning. The company addresses these challenges by focusing on long-term investment and maintaining clear communication with shareholders. This approach reduces panic and ensures the strategy remains effective despite market fluctuations.

Media Coverage and Public Perception

MicroStrategy Bitcoin regularly appears in the news. Every purchase, statement, and update attracts attention from both traditional and digital media. This coverage helps educate the public about Bitcoin while showcasing MicroStrategy as an innovator. Positive media attention reinforces investor confidence and sets an example for other companies considering digital assets.

The Future of MicroStrategy Bitcoin

The outlook for MicroStrategy Bitcoin remains positive. Analysts predict the company will continue acquiring Bitcoin and may expand its strategy further. MicroStrategy Bitcoin also serves as a model for other businesses. Observing the company’s strategy helps executives understand how to combine innovation, risk management, and long-term planning to succeed.

Key Lessons from MicroStrategy Bitcoin

Bold Moves Can Lead to Success

MicroStrategy Bitcoin proves that carefully planned, bold decisions can create major opportunities. Risk-taking, when done strategically, can set companies ahead of the competition.

Transparency Builds Trust

By sharing its Bitcoin strategy publicly, MicroStrategy reduces investor uncertainty. Clear communication builds credibility and strengthens support.

Focus on the Long Term

MicroStrategy Bitcoin shows that patience and planning are crucial. Consistent investment and long-term vision outperform short-term speculation.

Conclusion

MicroStrategy Bitcoin is more than an investment it is shaping the way businesses approach finance. Through consistent investment, strong leadership, and clear communication, MicroStrategy has shown that digital assets can be integrated safely and effectively. The story of MicroStrategy Bitcoin offers lessons in innovation, bold decision-making, and long-term planning. Companies and investors can learn from this example to navigate the future of corporate finance. For more strategies on corporate cryptocurrency adoption, check out our guide on how businesses are leveraging Bitcoin for growth.

Comments

There are no comments for this story

Be the first to respond and start the conversation.