fintech

A foray into fintech; a breakdown of the latest and greatest innovations in financial technology.

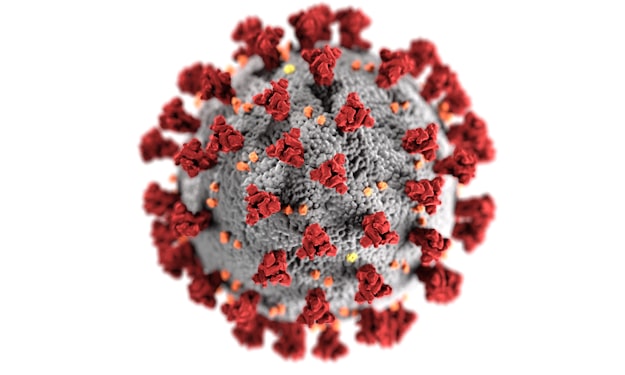

Will Fintechs be wiped out by Coronavirus?

The Coronavirus outbreak is disrupting lives across the world and is having a significant impact on the global economy. The damages are expected to be long-lasting and the recovery very slow, most likely over a number of years. It could accelerate the death of cash as a form of payment. By some accounts, it could be the worst economic crisis in 300 years. This would mean a much bigger impact on businesses around the globe than the Great Financial Crisis or even World War II. Fintech was born out of the last economic crisis, but how is this crisis going to impact the industry? Will fintechs wiped out by Coronavirus or will it come out stronger?

By Fintech Review5 years ago in Trader

Are low interest rates any good for Banks and Fintechs?

As the fallout from the Covid-19 pandemic takes its toll on economies around the world, central banks are cutting their base (or discount) rates to new lows. This is the rate at which a commercial bank can borrow from a central bank, like the Fed in the USA or the ECB in the Eurozone, when it needs to. These rates were already significantly lower than before the Great Financial Crisis. Some central banks are even going negative, which is particularly uncommon. A monetary policy experiments from economics books. Are low interest rates any good for banks and fintechs? Or is a low interest rate environment negatively impacting financial services?

By Fintech Review5 years ago in Trader

Is Blockchain a revolution for financial services?

There is a lot of hype around blockchain technology. Some of it is driven by crypto, and more notably Bitcoin (if you have not heard about it yet, you are living in a bubble). Some of the hype comes from the potential applications of the technology in several industries. However, these two things are quite different. Let’s have a look at how blockchain might transform financial services.

By Fintech Review5 years ago in Trader

Fintech funding reaches new records

It seems that when it comes to funding for Fintech startups, sky is the limit… According to data released by international consulting firm KPMG, fintech companies in the UK have attracted a record $48.5bn (£37.4bn) of investments in 2019, up 91 per cent from $25.4bn a year earlier. That’s quite a big jump, even in the Fintech world. Volumes were also up, as the number of deals reached a six-year high. You can see similar trends across other European countries, Asia, and the USA.

By Fintech Review5 years ago in Trader

Why Santander spinning off Innoventures is interesting

Santander, the Spanish banking giant, announced that from now on, Innoventures would operate as a separate entity. It is the bank’s Corporate Venture Capital (CVC) unit, set up in 2014 and responsible for investing into promising startups. It will be called Mouro Capital and have $400 million under management. Not too bad to get started.

By Fintech Review5 years ago in Trader

What is Regulatory Technology or Regtech?

The demand in terms of compliance is ever increasing within the financial services industry. As a classic example of efficient market dynamics, it means that a number of innovative Regulatory Technology (RegTech) startups, seized this opportunity and started to flourish to meet those demands.

By Fintech Review5 years ago in Trader

What is Fintech? - Fintech Review

Let’s start from the beginning. What do we really mean when we talk about Financial Technology, better known as Fintech? You will have obviously noticed that it is a very trendy topic these days. You will have read all about it in the press or elsewhere for sure. So what is it then?

By Fintech Review5 years ago in Trader

What are the potential use cases of Decentralized Finance?

What is DeFi ? DeFi stands for decentralized finance which is a more evolved and technologically advanced alternative reality of the centralized fiscal arrangement that we currently deal with. Using these words may make it sound like science fiction, but in reality, it is already here, and it is changing the financial architecture of the world.

By Ralph Kalsi5 years ago in Trader

HERE’S WHAT’S NEEDED FOR FANNIE MAE, FREDDIE MAC TO EXIT CONSERVATORSHIP

Before Fannie Mae and Freddie Mac exit conservatorship, several things still must happen. As the presidential election approaches, the Federal Housing Finance Agencies and the government-sponsored enterprises are entering crunch time.

By Jacob Wolinsky5 years ago in Trader

FinTech Startups & The Established Financial / Banking Institutions : PART — I

This article is 1st of the “Fin-Tech Start-Ups & The Established [ Financial ] / [Banking ] Institutions “ Article Series. In this Series, I will briefly discuss the ‘Current FinTech Start-Up Space’ and ‘different Distributed Ledger based [ Financial ] / [ Banking ] Solutions’ currently under development by Different Consortiums formed by different Banking / Payment / Investment Institutions .

By Rahul Mittal5 years ago in Trader