personal finance

The ABCs of personal finance and investing; how to invest wisely and grow your wealth.

Can I Sell My Life Insurance Policy?

When it comes to insurance, life insurance tends to fall fairly low on the list of priorities for many. Plus, since most policies tend to follow a sort of “set it and forget it” model, it can be easy to disregard a life insurance policy once it’s in place. However, there are plenty of extenuating circumstances that may prompt a policy holder to sit down at the computer and Google “selling my life insurance policy for cash.” But it’s not only about knowing if it can be done, but also how, so you don’t make any costly financial missteps.

By Claire Peters6 years ago in Trader

Becoming Effective

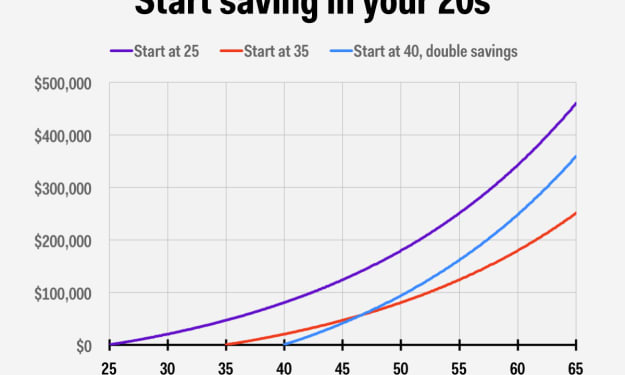

You’re probably familiar with interest. Maybe you’ve had a savings account that accumulates a small amount every month. Or maybe you have a credit card or loan that accumulates a huge amount every month. But do you know that there are different types of interest? And did you know that you can make interest work for you? It’s an effective way to grow your wealth, and it's easier than you might think!

By Isaiah Goodman6 years ago in Trader

What’s the Average Interest Rate on a Hard Money Loan?

In the past, hard money loans had a negative connotation. If you heard the words “hard money loan,” you may have thought about shady business dealings with questionable lenders and loans with exorbitantly high-interest rates attached to them.

By Casey Chesterfield6 years ago in Trader

Improve Your Credit Score

Your credit is as important as your money. If you don't have the money to pay for something, good credit could get it for you anyway. You could walk into a bank, and get the money to get what you need because they trust you. The bank knows that you have a history of being responsible with money, because of your credit. Good credit will get you a credit card that could pay for something you want as well. Your bank knows that you will pay the money back on time.

By Craig Middleton6 years ago in Trader

Ways to Mix Money and Morality

Virtually everyone wants to be a good person. The vast majority of us would like to live comfortably and make plenty of money, too. But those two things don’t always play nice with each other. As we strive for success, we might find ourselves questioning our actions and our accomplishments. Are we doing the right things? Are we honoring our values? There’s a reason so many movies are about leaving the “wrong” job for a more charitable one, or finding out that family is more important than long hours of the office. These stories are based on anxieties that many of us have.

By Carlos Fox6 years ago in Trader

Becoming Attentive

Everyone has heard the saying that nothing is certain except for death and taxes. Both of these are scary things for people. However, by learning a little about taxes, you can make smart decisions to ensure you understand how you can optimize your resources.

By Isaiah Goodman6 years ago in Trader

Top Tips for Finding the Best Mortgage Rates in Kansas City

When it comes time to purchase a home, one of the most important steps is finding the right mortgage. A mortgage is something people carry with them for a very long time, so it’s important to find the best rate possible. Fortunately, with some dedicated time and plenty of research, borrowers can find the right rate for their situation. But what exactly can borrowers do to ensure they’re getting the best mortgage rate possible?

By Tobias Gillot6 years ago in Trader

I Actually Started Budgeting

For the past month, I’ve been obsessing over finances. Not how to make money—but what to do with the money I make. I get a paycheck twice a month doing contracted tutoring through a company. I have students loans I need to pay off and want to come up with a plan on how to get that taken care of so I don’t have to defer it indefinitely (bad move).

By Fully Functioning Female6 years ago in Trader

Join the Revolution: Fee-Free Bank Accounts and Feature/ Benefit Comparison

Banking is a huge part of modern day economics. Banks have a large role and as such, sometimes too much power. I got my first bank account at around age 12 because I was making some money buying and reselling items on Craigslist and thus needed an account for safe-keeping. I thoroughly enjoyed the benefits of having my money so easily accessible in the online world, yet many things about the whole system bothered me. I distinctly remember one situation where I'd run out of money but they still processed an online order AND charged me an overdraft fee. I didn't understand why they couldn't just not let the transaction go through. Even as a kid, I knew that practice was wrong. Today, I understand more about banking and the economy, and still adamantly believe that bank fees are yet another way to make everyday life harder for those surviving on low incomes, and as such should be stopped.

By Brittney Walker6 years ago in Trader

How I'm Budgeting to Pay off My Student Loans

Originally posted to my blog. I just spent the past two hours looking at the student loan debt I owe. It’s a hefty amount—but not as much as most people have to pay. Since I make money on a more consistent basis now (and even started budgeting with each bi-weekly check), I need to start budgeting for paying down my ONLY debt I owe—my student loan debt.

By Fully Functioning Female6 years ago in Trader

Payday Loans: A Guide (and Warning) for First-Timers

Payday loans are very short-term loans that can only go as high as $1000, depending on state legal maximum, and they must be repaid on your next payday, hence the name. To get the loan, you must write a check for the amount borrowed plus a fee. The due date is usually two to four weeks after the loan was made, and the exact due date is agreed upon on the payday loan agreement.

By Marian Woodsen6 years ago in Trader